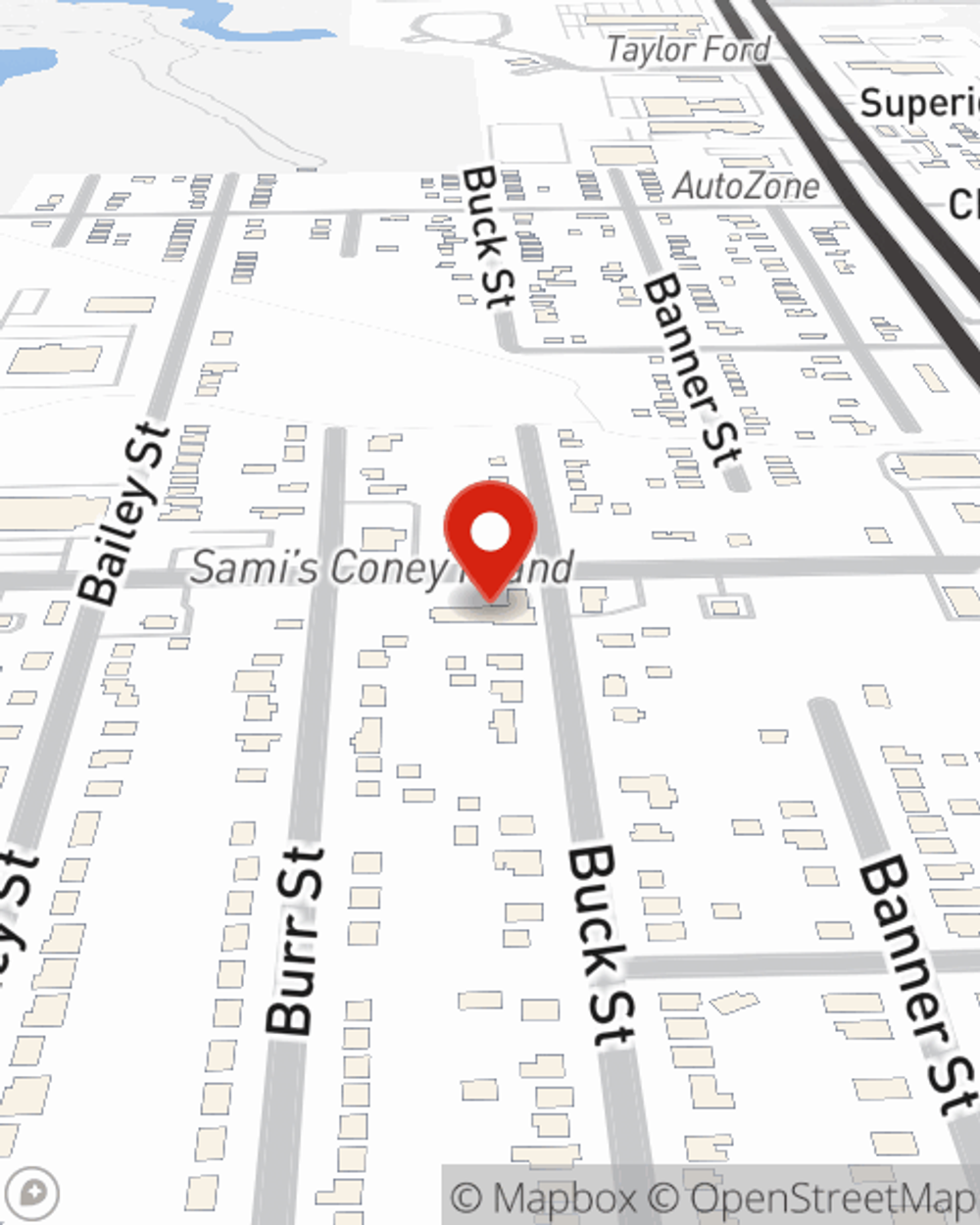

Business Insurance in and around Taylor

One of Taylor’s top choices for small business insurance.

No funny business here

Help Prepare Your Business For The Unexpected.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Accidents happen, like an employee gets injured on your property.

One of Taylor’s top choices for small business insurance.

No funny business here

Small Business Insurance You Can Count On

Planning is essential for every business. Since even your most detailed plans can't predict global catastrophes or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like extra liability and a surety or fidelity bond. Terrific coverage like this is why Taylor business owners choose State Farm insurance. State Farm agent James Fedewa can help design a policy for the level of coverage you have in mind. If troubles find you, James Fedewa can be there to help you file your claim and help your business life go right again.

Intrigued enough to research the specific options that may be right for you and your small business? Simply get in touch with State Farm agent James Fedewa today!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

James Fedewa

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.